@mbontrager5

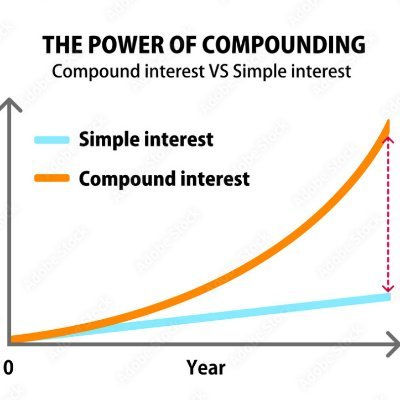

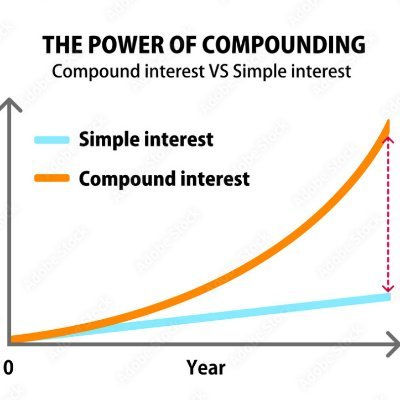

Promoting the pursuit of learning & financial education. | Consumer of iced coffee & sweet tea. | RT/Likes ≠ Endorsement. | Views are my own.

@mbontrager5

Promoting the pursuit of learning & financial education. | Consumer of iced coffee & sweet tea. | RT/Likes ≠ Endorsement. | Views are my own.