1/ There's a new player in town!

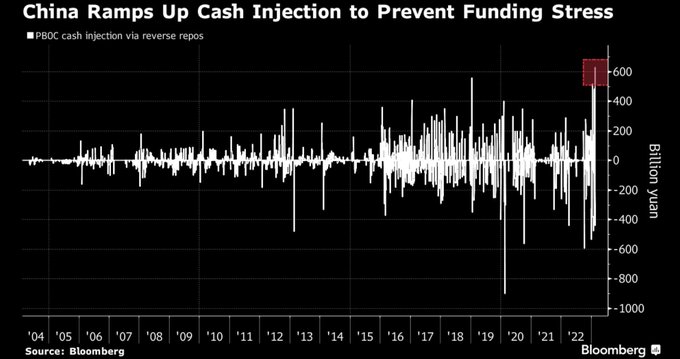

China's central bank performed it's single-largest liquidity injection on Friday, to help support their economy out of historically depressed levels.

+ there's more to come 🇨🇳

137

671

3K

Replies

2/ China boasts the world's second largest economy and has recently expanded at a pace ~2.2% faster than the US.

The People's Bank of China (PBoC) are the world's third largest central bank with ~$6T in assets and play a key role in global liquidity.

7

29

294

3/ While most analysts are focused on how the Fed tightening will reprice risk assets this cycle, they're failing to consider the scale of easing in the east.

Japan (4th largest CB) + China are injecting liquidity into global markets, easily outpacing the Fed tightening efforts.

8

68

353

4/ Thinking of global liquidity rather than the US in isolation could prove to be more powerful when analysing crypto markets.

The Fed are tightening (risk-off), but the world's third + fourth largest central banks are easing, actually causing an uptick in global liquidity!

9

47

307

5/ Crypto is not tied to any particular economy or entity, but rather is a liquidity junkie - it longs for the risk-hungry investor to get cash and bet on the fastest horse. That's set to be exactly what will happen this year in China.

5

33

315

6/ The makings of an economic recovery in China were evident when the 'zero covid' policy was abandoned in late 2022.

Lockdowns during 2022 derailed the expansive growth that's been so characteristic of China's economy in the 21st century.

1/ One narrative that CT is not talking about, is China's zero-covid policy.

After months of strict covid-zero policy, it seems China is ready to loosen its stance.

According to

@Reuters

, further easing could be announced as soon as Wednesday - and that would be bullish risk

21

20

176

2

13

160

7/ The end of this policy has helped lift demand + resume consumption. New Chinese bank loans hit a record 4.9T Yuan in January - a 23% increase YoY!!

Analysts suggest that this data could indicate that the economic recovery in 2023 has potential to exceed the pre-pandemic level

2

20

198

8/ This renewed demand has placed stress on the Chinese banking sector. If liquidity is not ample enough to meet demand, the system struggles and that's what has happened recently!

Rates on short-term borrowing hit the highest levels since early 2021 last week... Cue the PBoC!

2

10

160

9/ The PBoC are showing that they are keen to play their role in stimulating the Chinese economy.

Last Friday, $92bn USD (net) was injected to bring down borrowing rates and make cash easier to come by - which is not too dissimilar to what the Fed did during the pandemic!

3

15

190

10/ Economists/analysts expect this to be the theme out of China in 2023 --> Many expect the PBoC to cut rates in the coming months to further support and promote a prolonged economic recovery.

2

11

166

11/ Of course, not all of the cash injected by the PBoC will end up in risk assets. But I'd bet that a decent portion of it will!

Just like we saw from the West in 2020, heightened liquidity from central banks = prices of risk assets (like

#BTC

) go up.

29

28

326

@tedtalksmacro

China's real estate debacle is more than enough of a chasm to absorb much of it

2

2

44

@Mayhem4Markets

absolutely, but the printer is being turned on in a big way.

Hello inflation exports to the US 🥵

9

4

83

@tedtalksmacro

Thank you Teddy! You are becoming Macro go to on CT for so many of us. You are much appreciated in this space ❤️

3

0

16