1/ BTC has been around since 2009, and so far we can say that

#Bitcoin

bear markets typically end:

🔻 After price moves -85% off the previous bull market high.

⏱ ~470 days before the next halving

[A thread on a macro bottom + new bull cycle]

174

284

944

Replies

2/ BTC is +44% in January alone, traders are beginning to wonder if the lows are already in and many people are sidelined 🤷♂️

Institutional capitulation has seemingly peaked, the 2024 Bitcoin halving is becoming closer by the day and the Fed are close to pausing rate hikes.

4

3

97

3/ There are many, many metrics and arguments that you can use to attempt calling a macro-bottom on BTC, but I'm going to keep it simple...

Let's compare the current bear market drawdown to previous cycles, especially with regard to time, price and macro-economic context.

3

1

77

4/ Like I said in the first tweet, Bitcoin bear markets typically end:

🔻 After price moves -85% off the previous bull market high.

⏱ ~470 days before the next halving

(albeit with a small sample size)

5

4

70

5/ As of January 2023:

✔ The next BTC halving is due in ~450 days

❌ Bitcoin has moved lower by 78%

Price is slightly off, but timing is consistent with previous cycles.

It would take a move to $10,200 for BTC to fall ~85% off the highs like previous bear markets!

4

1

73

6/ For an even stronger opinion of when the next bull cycle will occur, combine BTC cycles with their macro-economic context 👇

Central banks decide when the market goes up or down, by providing liquidity to the market.

When liquidity is abundant, market go up 🚀

4

5

75

7/ Previously, crypto didn't care for macro... but given the heightened InSTitutiOnal adoption in 2020 and 2021 it now very much does.

But what if I told you it always has cared, we just didn't notice as the market was in 'easy mode' for a decade?

8

3

77

8/ It's only in 2022 + 2023 that we have begun to question if the money printer will be turned off, at least for a little while.

Prior to 2022, BTC had never experienced a macro-environment where the Federal Funds Rate (FFR) was >2.50%

In 2023, the FFR is approaching 5.00% 📈

3

3

55

9/ That doesn't mean that it's over for the bulls just yet though.

2022 saw aggressive tightening from most of the world's central banks in reaction to unprecedented liquidity provision.

But things aren't so vastly different to previous 'macro' cycles as they're made out to be.

4

3

61

10/ If we compare the macro-economic context with prior BTC price + time cycles, there is no doubting a distinct pattern.

1. Stimulate (money supply 📈)

2. Pause

3. Tighten (money supply 📉)

4. Pause

5. Stimulate (money supply 📈)

Simply, we are currently at 3. moving into 4...

4

8

64

11/ Monetary policy cycles are more nuanced/sensitive than what Bitcoin's price + time cycles are.

However, this graphic is brilliant to illustrate how macro cycles have become intertwined with BTC's halving cycles to date.

6

6

62

12/ CBs will pause on tightening this year, however, the risk is that global monetary policy remains restrictive if inflation stays elevated.

The question for macro right now is how much deterioration will occur in global growth this year + will that cause a prolonged recession?

4

2

60

13/ If inflation is calm and growth deteriorates quickly due to the lagged impact of tightening (yet to see), central banks can turn the money printer back on in 2024.

However, if there's deteriorating growth + persistently high inflation, that could mean a prolonged recession.

3

6

62

14/ A prolonged recession in the US and globally would be bearish for all risk assets.

If people can't afford their cost of living, they sure as shit aren't going to be investing!

Savings will be erased, unemployment increased and fear heightened.

4

5

70

15/ Despite all of this macro mumbo jumbo,

Historically the lead up to each BTC halving has formed the bottom in preparation for the next bull cycle.

Each halving causes the issuance of Bitcoin to decrease, thus fuelling the 'store of value' or 'digital gold' narrative 💰

5

6

82

16/ BTC's annualised rate of inflation is predictable (currently at ~1.83%) and when you consider US CPI is at 6.5%, the store of value argument makes sense.

BTC's issuance decreases predictably and is capped at 21M, while central banks continually print more fiat supplies.

6

7

78

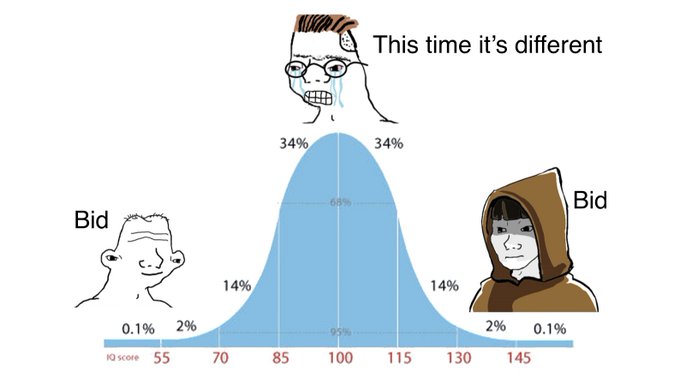

17/ It's just a matter of 'is this time different?' 🤔

Although the monpol may have become restrictive for now, the potential for macro-policy shifts in 2023 line up nicely with the BTC halving in 2024. Posing a two-pronged attack for the stubborn beras.

In the meantime, I bid.

22

11

213

@tedtalksmacro

We must also remember that the last cycle did not have a blow-off top high, which asks the question will we still drop 85%. I personally think we need a black swan to go back down to 10k. The next question is where do you think this rally will top?

1

0

3