This is only a small glimpse of the whole report. You can access the Indus Valley Annual Report 2024 at

If you enjoyed reading it, then please do share it forward if you liked it, and of course, feel free to tweet or post about it.

5

18

59

Replies

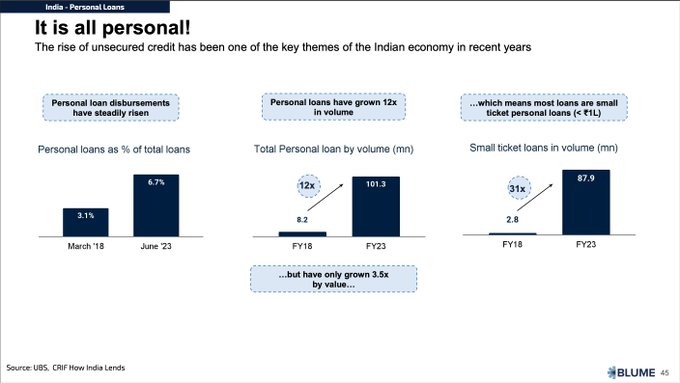

6. The rise of personal loans has been one of the key themes of the Indian economy and how small ticket loans have grown 31x in the last 5 years. We try to unpack what is happening in personal loans and why RBI is worried.

1

1

21

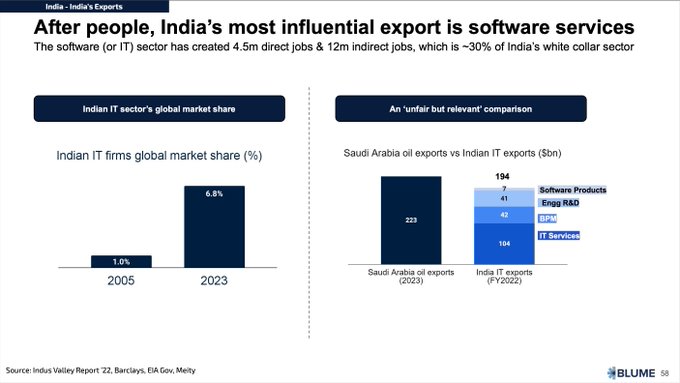

7. India’s story is incomplete if we don't talk about its IT sector and how it has been powering the Indian economy, it also relates to how in many ways India exports its people, services and culture to the entire world.

1

0

18

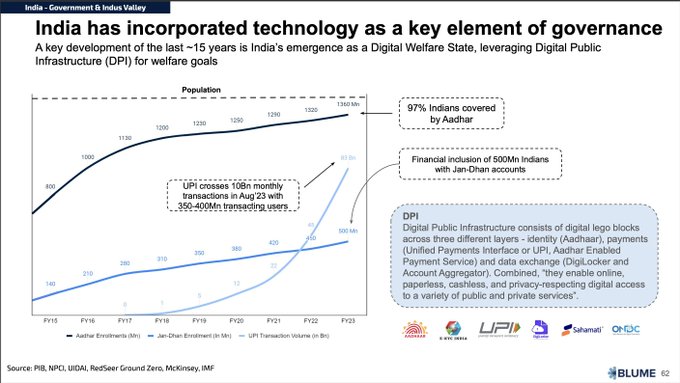

8. A key development and observation over the last 15 years is India’s emergence as a digital welfare state, leveraging digital public infrastructure (DPI) to reach every person in the country and also how DPI has been a key driver for Indian startups.

1

1

23

9. Now to Indus Valley.

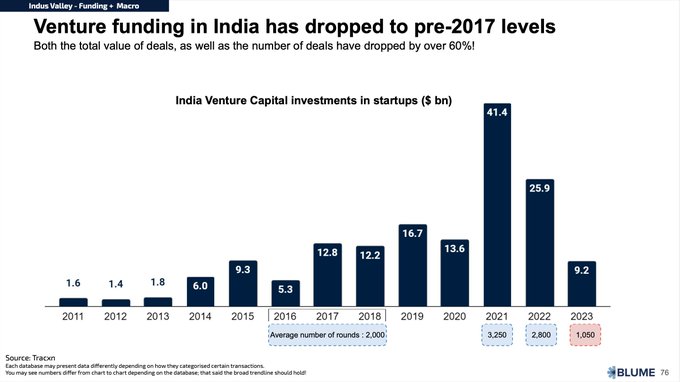

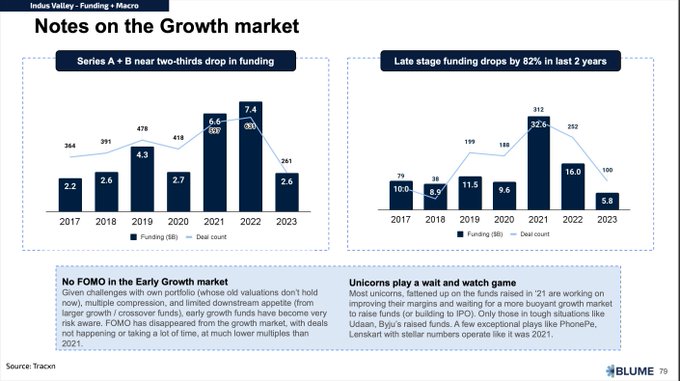

Now, it’s no surprise that funding has gone down over the last couple of years.

Here is how it stacks up.

1

0

14

10. When we drill down, we find it is late-stage funding that has led to the decline, where both investors and founders are playing a wait-and-watch game.

1

0

12

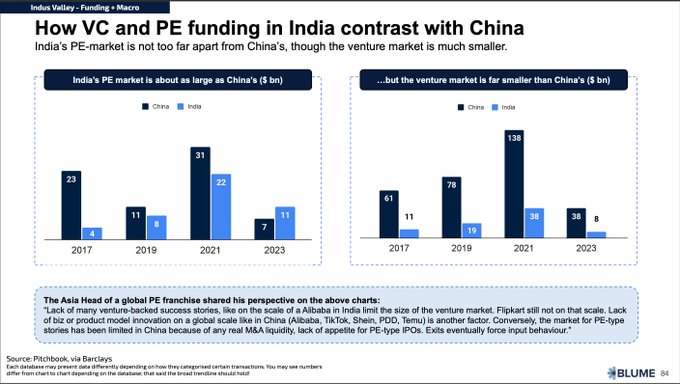

11. One big learning while making this report has been how different China vs Indian private markets have been, how Indian PE markets punch above their weight in comparison to China and how it is a function of delivered exits and public investor’s appetite.

1

0

17

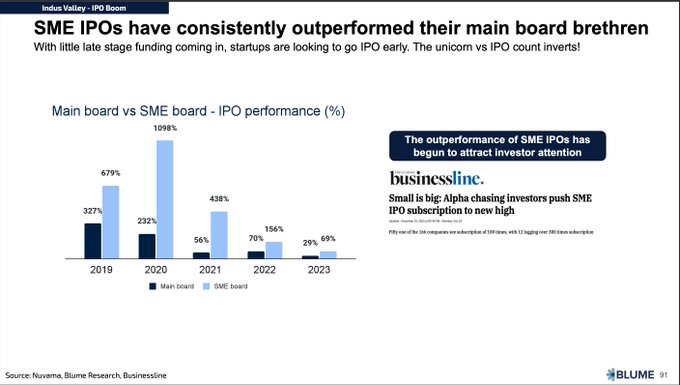

12. One interesting angle on the SME IPOs is that they have continuously outperformed the main board over the last few years.

1

1

15

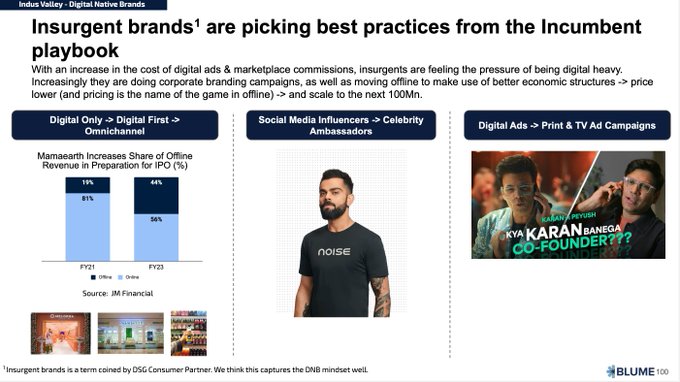

13. A key theme in the Indian startup ecosystem of late has been the rise of Digital Native Brands, which have been growing steadily over the last few years and beginning to create their playbooks of international as well as domestic expansion.

1

3

16

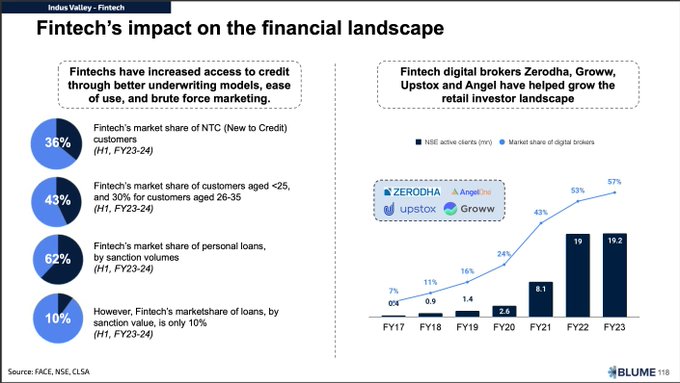

14. Fintech has leveraged UPI to grow rapidly, right from having a majority market share in retail broking to leading access to credit for underserved customers in India.

1

0

15

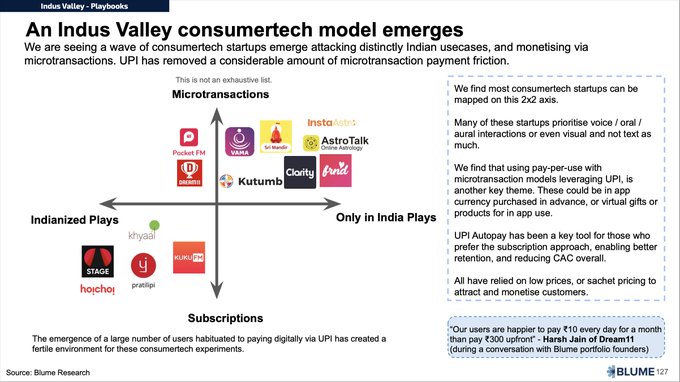

15. Indian startups are also creating a distinct monetisation playbook, by enabling microtransactions, or subscriptions built on top of UPI Autopay, when very few believed that Indian customers would pay or that the only way to monetise was via ads.

2

0

22

Thanks from team IVAR

@sajithpai

@llnachull

@anurag_pagaria

, and we have a small surprise coming your way very soon. So stay tuned!

7

3

36

If you are more into listening rather than reading or want a companion guide to understand the report better. 90 mins of us taking you through each section and our thought process behind it

0

0

5

@anurag_pagaria

@BlumeVentures

great weekend read! yesterday's report that India grew at 8.4% in the last quarter of CY2023 should support some of the arguments made in this IV report!

0

1

1