Back your winners

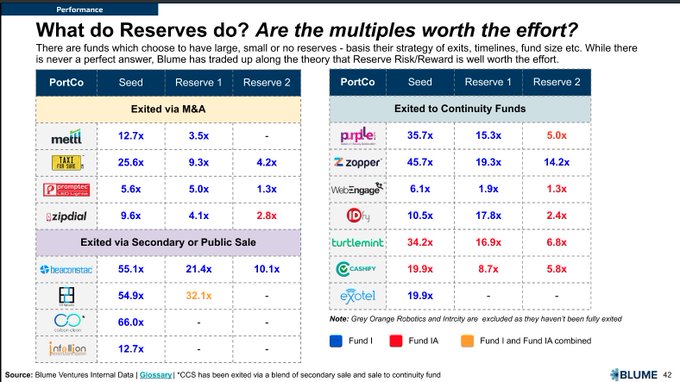

7. Reservers are essentially, a part of the fund which is kept purely to bet on winners - to get the most out of them.

With only a few startups that strike out - becomes paramount that you bet on the ones that are taking off

1

0

2

Replies

@BlumeVentures

/

@BKartRed

latest report on Blume's Venture fund performance is a gold mine of insights into the Indian VC - Startup ecosystem and how Venture Capital firms operate.

Here are 7 things I learned from this 🧵

2

2

8

Highly recommend that you enjoy the full report -

Though I work at Blume so might be biased, however, this report gives you a very good sense of how the Indian startup system has evolved, what works, what doesn't from the lens of largest homegrown fund

1

0

1

How do you raise your first fund?

1. After pitching to 600 HNI's ( Not institutions), got a commitment from 80 people where 100% of the capital was Indian

India in 2011 was unproven VC Market + Karthik and Sanjay, first-time managers - More like a seed round story

1

0

1

Aggregate Performance

2. Projected to close at 6x gross where the deployment was in a 3-year trench

1

0

1

Failures happen early, Exits happen last

3. The majority of the fund 1 return has come about in the last 3 years, while the deployment started 12 years back

1

0

1

Series A is where most startups die

4. 40% of our fund 1 companies moved to series A, with a 2 years waiting period

IMO this primarily happens as series A or early Series B is a clear sign that startup has hit PMF, before that all of them are trying to find it.

1

0

1

Where do deals come from

5. 99% of our startups came via referral or a network

Referrals, referrals and more referrals - separates out signal from noise

Now a lot more traction-based sourcing also happens - ex Github repo adoption, app analytics tracker etc

1

0

1

Power law is the foundation of Venture Capital

6. 6% Startups return 20x

9% - 10x

50% - 0

Which is why you hear things like fund returner, not large enough problem - every startup that a VC backs had to potentially be able to return the fund

1

0

2

The whole report has a lot more insights into which geography got the most exits, the journey of the fund 1 startups, How India quotient fund 1 performed and much more.

Major props to

@AdithyaS017

for bringing it all together :)

0

0

2