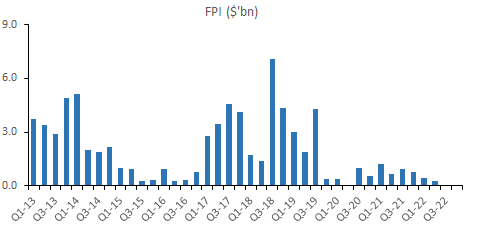

- In Q4-22, FPI was $288m, the lowest level since '16 when oil production and prices collapse brought Nigeria's economy to its knees.

- This time, the CBN must lead the supply at a rate equal to what markets dictate

- All special windows must be discontinued, including FORM A.

2

9

15

Replies

- Everyone wants to know where the liquidity will come from.

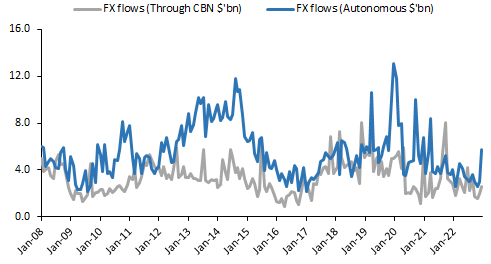

- Since I started tracking the data, the CBN has lost its monopoly power in FX supply. The Apex bank can deceive itself all it wants, it never had the firepower to dictate FX pricing, hence the arbitrage opportunity.

9

146

202

- As of Dec-22, autonomous FX supply delivered almost 70% of the market's total supply vs. 30% flow through the CBN.

- Thus, it is imperative for the CBN to put in place policies that will allow foreign portfolio investments (FPI) into the system

1

14

24

- Going by the last major economic shocks, the collapse in oil prices triggered massive investment outflows, and by extension, the Naira came under intense pressure.

- Beyond devaluation, and creation of a framework for investors to trade currency, CBN also had to step up supply

1

9

16

- From the chart above, both the CBN and autonomous flows grew steadily, forcing the NGN to appreciate against the dollar. But the CBN led.

- The bank conducted auctions twice a week and forced everyone to participate

- This time, the CBN waited too long an FPI dried up.

1

7

18

- Remove all the restrictions in the FX market, including cash dom accounts & allow Naira debit card to fulfill FX obligations

- FPI may be encouraged to return to invest in Naira assets

- And as with 2017, when rates moved from of N520 to N360, we may see a stronger Naira.

4

24

37

@Demo_AQ

Their inability to not keep up with supply typically stem from massive decline in oil revenue - it may be problems from price, production, or both. The implication is that rates go up when this happens.

1

1

0