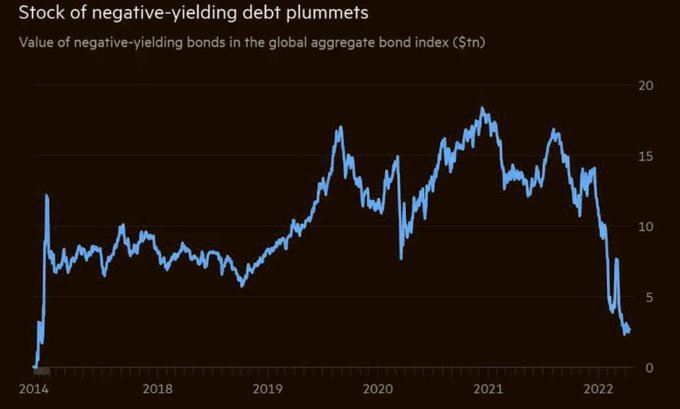

So you are telling me we just slashed $11T of negative yielding debt without a real blow up? 🤔

19

48

382

Replies

@Theimmigrant84

Doesn't this just means the price of those previously negative yielding bonds has come down enough to where they're positive yield? So the fraction of negative yielding debt to total debt has decreased, but it's not like $11T has been lost. I'm not sure this metric means much.

1

0

10

@Theimmigrant84

Oh sure all those bonds posted as collateral and listed as an asset will do just fine

1

0

4

@Theimmigrant84

Yield going from -0.0001 to + 0.0001 has roughly the same effect as it going from -0.0003 to -0.0001 .. which is almost nothing.. However, in the former case it may show up in your graph as a gazillion trillion dollar fall in negative yielding debt.

1

0

11

@Theimmigrant84

"The economy is faltering, and markets are becoming chaotic. In spite of this, the mainstream financial media is busy convincing investors that the bull market is solidly intact."

2

1

5

@Theimmigrant84

It did not disappear it’s still there, just yields more, in real terms. Nothing special about the 0 bound

0

0

0

@Theimmigrant84

Considering German bonds recently went to positive yield, I’d expect that to be at least a significant part of this.

0

0

1

@Theimmigrant84

Debt moving from negative 1 bps to positive 1 bps is inconsequential, even if trillions of dollars worth do it

0

0

0