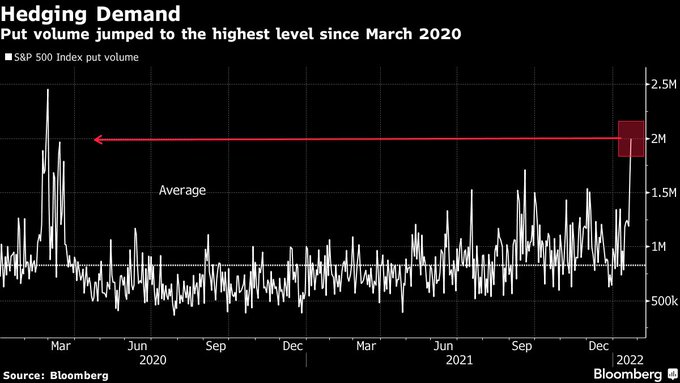

This is to put things into perspective. For the SPX, put volumes on Monday were the highest since March 2020. In Europe, demand for bearish contracts on the Euro Stoxx 50 Index topped 1 million contracts for the first time since December 👇

20

68

294

Replies

@Theimmigrant84

@Mayhem4Markets

@jam_croissant

@AlessioUrban

with high demand for bearish contracts, it seems that would further indicate that this week’s action has been hedging vs outright selling

1

0

11

@Theimmigrant84

@jam_croissant

@Mayhem4Markets

@AlessioUrban

Good sign since retail is always late to a trade. Probably means the bottom is in.

0

0

0

@Theimmigrant84

@jam_croissant

@Mayhem4Markets

@AlessioUrban

With respect, tweets like this make people want to buy more puts, even though this isn’t March 2020.

0

0

2

@Theimmigrant84

@jam_croissant

@Mayhem4Markets

@AlessioUrban

This could be a signal for a quick and strong rebound soon. If it does happen, I think it's more likely to be a short-term rebound than a longer-duration sustained rally.

0

0

10

@Theimmigrant84

@jam_croissant

@Mayhem4Markets

@AlessioUrban

Too many people to one side of the boat?

0

0

3

@Theimmigrant84

@Copernicus2013

@jam_croissant

@Mayhem4Markets

@AlessioUrban

It is seem like the stock market is now like a casino lol

1

0

2

@Theimmigrant84

@jam_croissant

@Mayhem4Markets

@AlessioUrban

Rebound for long enough for most of the value to expire. Then correction

0

0

2

@Theimmigrant84

@jam_croissant

@Mayhem4Markets

@AlessioUrban

Wall Street trying to front run and ending up 'out hawking' the Fed in the process.

0

0

7

@Mayhem4Markets

@michaelsantoli

Agreed. Massive put selling to retail. You think they’ll let those puts print? No way. Today, massive prints into levered long ETFs. Positioning is bullish.

1

0

4

0

0

4

@Theimmigrant84

@jam_croissant

@Mayhem4Markets

@AlessioUrban

Don't spoil the ending 🤣 Bottom is in. Dealers always win. Those puts will expire worthless. When retails buy puts dealers hedge gamma neutral positioning by buying the underlying stocks. Majority always wrong. Human behavior predictable.

#RoaringTwenties

1

0

5

@Theimmigrant84

@jam_croissant

@Mayhem4Markets

@AlessioUrban

When you say the first time since December, that was 26 days ago yo lmao….

0

0

0

@Theimmigrant84

@jam_croissant

@Mayhem4Markets

@AlessioUrban

Love the way everyone is now an expert long/short manager

0

0

0

@Theimmigrant84

@jam_croissant

@Mayhem4Markets

@AlessioUrban

Could you please explain why is Cboe SKEW index at one of the lowest levels if there is so much put buying going around?

0

0

0