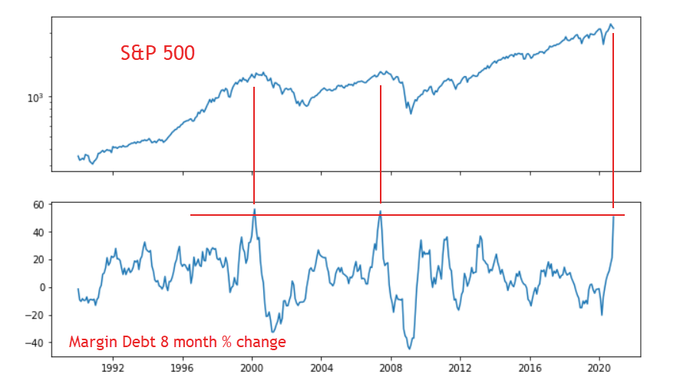

Margin Debt soared 50% in the past 8 months. In the past 30+ years, such investor euphoria happened exactly twice:

March 2000

June 2007

Now

h/t

@bullmarketsco

38

203

590

Replies

@Theimmigrant84

@bullmarketsco

Meaningless. margin debt always moves with the size of assets.

The more assets we have the higher the margin debt.

It’s like saying I have more risk now than 30 years ago coz my mortgage is at 3 mil now vs 250K.

Low yields, huge assets should mean we have access to record debt

1

0

1

@Theimmigrant84

@bullmarketsco

Very interesting though looks strange margin debt seemed to collapse but took several months for the market to sell off

0

0

0

@Theimmigrant84

@bullmarketsco

looking at your chart drop doesn't come straight away.

I would go with March if there is any trouble or If there is Biden Tax hike.

1

0

6

@Theimmigrant84

Keeping in mind it seems the differentiator is the bear market in 2020 producing the gain in margin debt unlike both 2007 and 2000

0

0

7

@Theimmigrant84

@bullmarketsco

If you add up all the leverage, margin debts, security lending and synthetic ETF risks, you'll be busy for hours and very worried afterwards.

0

0

4

@Theimmigrant84

@ContrariaTrader

@bullmarketsco

Incredible. What’s different this time are the poor ignorant Robinhooders that just see “buying power” and don’t understand. The pin to prick the bubble is a simple turn in sentiment in $tsla

0

0

3

@Theimmigrant84

@bullmarketsco

Why does the 8-month reference time span and not a longer or shorter one? Thank you

0

0

0

@Theimmigrant84

@bullmarketsco

8 month is the magic number to capture the absolute margin debt low in March, 2020. Very clever data manipulation trick to show whatever he wants to show (it's magic). In this case "market top".

0

0

11

@Theimmigrant84

@bullmarketsco

Elect a Repub President, and a recession always follows. Dems come in to fix it, McConnell blocks as much of the fix he can, then blames slower recovery on the Dems. Dems still fix it. GOP gets in, claims credit only to blow it up all over again. No one benefits but the richest.

2

0

8