1/ quick notes and data points from the discussion

@kellyjgreer

and i had at

@PubKey_NYC

last night

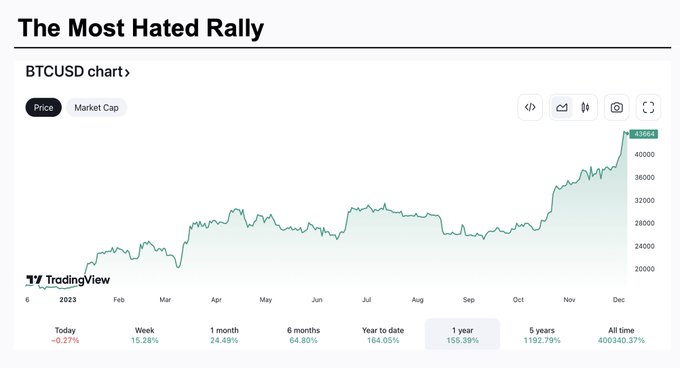

'tis the season of the most hated rally - bitcoin is ripping and macro folks are not happy about it

jamie dimon and elizabeth warren seem especially mad 😠 max cope incoming

34

107

589

Replies

2/ bitcoin pricing is driven by FLOWS

it's tempting to get lost in piles of analysis but as we'll discuss later on, the key to understanding is looking at open positions, trade volume, inflows and outflows

sentiment doesn't matter until it's expressed as a trade

1

3

80

3/ bitcoin is highly reflexive

i had a moment of enlightenment a few years back. i used to believe narrative -> sentiment -> flows -> price but it's really much simpler

price drives action

this is what

@saylor

$MSTR has perfected. buy, price goes up, follow with narrative

5

5

77

4/ quick sidebar - liquidity

understanding the structure and depth of markets matters. the unique properties of bitcoin and how tsxn's trade, clear, margin, settle etc has created an entire ecosystem of new venues that weren't always so liquid.

2

0

26

5/ the evolution of bitcoin market structure has been a *hell* of a ride littered with blowups, blowouts, glowups, and just straight up fraud

we're currently in our institutooootional era, with many traditional market participants and venues joining the fun

6

7

63

6/ now to the flows

bitcoin markets have an abundance of useful data on flows because everything is on-chain

as of today, 80% of the bitcoin supply has not moved in over a year. that's a big number.

top is in when LT holders to start selling 👀 (blue line down, red line up)

4

3

69

7/ i'm also a big fan of tracking crypto product flows, since it represents retail and insto buyers of the type who would buy the ETF.

we're on week 10 of consecutive inflows into crypto products, and the majority of demand is still for bitcoin

1

0

42

@CoinSharesCo

8/ so who's gonna be buying corn in 2024? where will these flows come from?

👇 these institutions and their clients, baby

distribution is the name of the game, and these firms have massive distro channels they'll use to promote and sell their bitcoin products and services

3

8

60

@CoinSharesCo

9/ retirement assets are the holy grail - $35T pie and growing

not many efficient ways to put bitcoin in a retirement portfolio. publicly listed co's offer (levered) bitcoin beta and products like GBTC have structural challenges re: maintaining NAV

but soon... spot ETF

3

8

53

@CoinSharesCo

10/ quick rip from Kelly and the

@galaxyhq

team on ETF demand / flows estimates

Total BTC in current ETP/Fs: $33B (4% of BTC supply)

Boomers & earlier (aged 59+) hold 62% of US wealth, yet only 8% of adults age 50+ have invested in crypto vs. 25%+ for adults aged 18-49 (Fed,…

6

5

52

@CoinSharesCo

@galaxyhq

11/ markets - let's start w spot

BTC daily volume = $10B

BTC is ~1/3 of the $30B total daily volume - peak was $150B / day in 2021 bull, bottom in at $10B / day

of this flow, ~50% on Binance

most gains during US market hours (Saylor daddy) - flat during Europe + Asia hours

2

1

28

@CoinSharesCo

@galaxyhq

@TheBlock__

12/ retails tends to trade spot

retail traders net bought $6.8B in *equities* this past week, the largest retail inflow in 20+ months (

@Oppenheimer

)

WE ARE SO BACK

@CashApp

gross btc transaction activity was $2.4B in 3Q 23 -> this translates to $27M / day on avg. remember…

2

0

28

@CoinSharesCo

@galaxyhq

@TheBlock__

@Oppenheimer

@CashApp

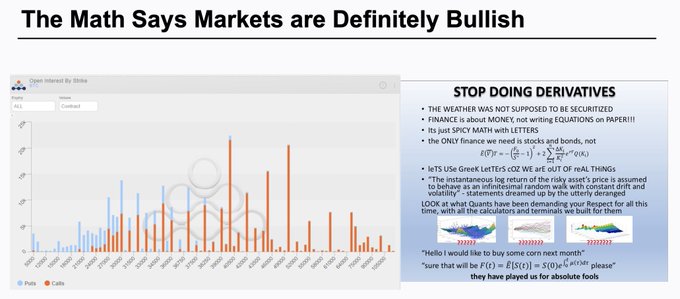

13/ derivatives

we just hit a record ATH for open interest (OI) which an important liquidity measure - OI reflects the number of contracts held by traders in active positions

$20B OI on crypto native platforms + $5B OI on CME - $25B baby

1

1

26

@CoinSharesCo

@galaxyhq

@TheBlock__

@Oppenheimer

@CashApp

14/ the real flippening is we're watching is CME bitcoin futures OI surpassing Binance for the first time ever this week

remember, to trade on CME you have to be an institutioooon, do KYC, post cash, etc etc. the big bois are coming out to play.

2

5

50

@CoinSharesCo

@galaxyhq

@TheBlock__

@Oppenheimer

@CashApp

15/ if we look at options, the market is bullish

x-axis is strike prices in increasing order, orange bars are call volume (bet that BTC go up), blue bars are put volume (bet that BTC go down)

orange > blue, more money is betting BTC up v BTC down

5

3

39

@CoinSharesCo

@galaxyhq

@TheBlock__

@Oppenheimer

@CashApp

16/ bitcoin's number go up tech is impressive, but the future is so much bigger

IMHO the portfolio of the future is ENERGY, COMPUTE, CRYPTO (nfa, dyor, etc)

bitcoin is all 3 and enables beautiful, beautiful financial engineering but is tethered to the laws of thermodynamics

3

8

59

@CoinSharesCo

@galaxyhq

@TheBlock__

@Oppenheimer

@CashApp

17/ that's all the girl math we had time for

hopefully you enjoyed this edition of wammin' doing bitcoin things

please tip generously when you visit the great folks at

@PubKey_NYC

and feel free to buy me and Kelly some beers (tecate for her, high life for me)

8

8

114

@Melt_Dem

@kellyjgreer

@PubKey_NYC

"Efficient redistribution of income via a UBI requires strict, warrantless tax surveillance, banning all self-custody of digital assets and a free public sector-operated CBDC system to bank the unbanked and free bank users from regressive fees and predatory lending by private…

0

0

3