Replies

Pancakeswap is currently live on Mainnet, BNB, Arbitrum, Base, zkEVM, and Linea through our UI.

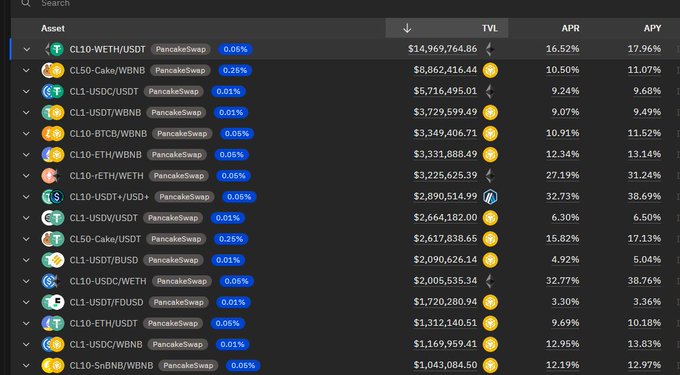

The APRs listed are the average CAKE APR currently earned by all participants in each pool.

2/7

1

0

3

Out of $15.2M Staked TVL in the CL10-WETH/USDT pool on Mainnet, currently $15M is Active (the price is within the range), but out of that only $24k is Rewarded (within the active tick space, which is 10 ticks or 0.1% wide).

3/7

1

0

3

Our UI shows the average APR of 16.5%, and then calculates a range which would achieve this same average APR. In this case this range is $2257 - $4230 (-31.3% to +31.4%)

4/7

1

0

3

While that range greatly diminishes risk of the position going out of range, it does so at the cost of APR. Through our UI you can select different ranges to view the different possible APRs.

5/7

1

0

3

The position size is also taken into account, e.g. depositing 10 ETH in this example vs 1 ETH in the previous one reduces the APR accordingly.

6/7

1

0

2

The narrower the range, the higher the APR, and correspondingly the risk of losses due to price fluctuations. Our aim is to offer LPs and traders all the relevant data so they can make informed decisions.

7/7 - End of message

1

0

4

@vfat_io

@PancakeSwap

Been loving the product

Ui is so great and product is the best to use imo

Super helpful to anyone trying to get a better understanding on CLPs variations and it's aprs

Way to go ! Thank you Kind sir

0

0

0