7) Low transaction cost: Due to stronger liquidity and higher trading volume in derivative (perpetual contract) market, transaction cost tend to be lower, which in turn will boost user friendliness and retention.

1

0

1

Replies

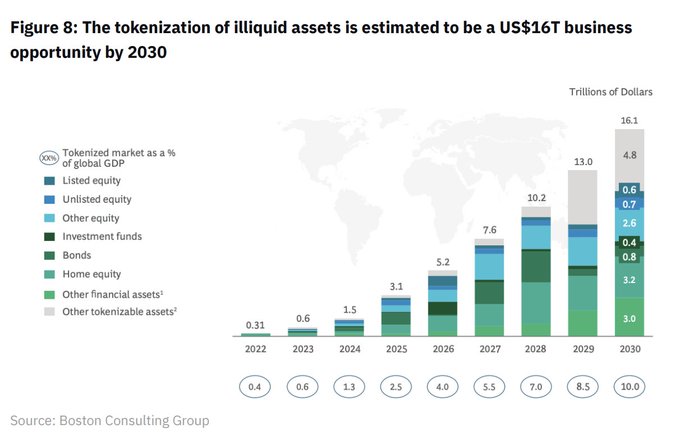

1) According to Boston Consulting Group, on-chain RWA market size will exceed $4 trillion by 2030, almost 4X of current crypto market. The economic value generated from trading in such market will be huge. We believe that perpetual contract is the best trading instrument.

1

1

4

2) When it comes to RWA trading, perpetual contract (derivative) comes with the most benefits, comparing with two other approaches: synthetic asset (over-collateralize crypto) and RWA tokenization.

1

0

0

3) Capital efficiency: Perpetual contract is the most capital efficient way to trade due to its leverage accessibility. Tokenization requires collateralizing at least equal value of underlying RWA, while synthetic asset requires over-collateralization.

1

0

0

4) Capital efficiency: Think of it as

1. uses $100 as $1000 (perpetual contract with leverage),

2. use $100 as $90-100 (tokenization with collateralization)

3. use $100 as $30-60 (synthetic asset with over-collateralization)

1

0

0

5) Short accessibility: Perpetual contract can be short directly, while users have to borrow synthetic asset and tokenized RWA before short selling.

1

0

0

6) Strong liquidity: Due to the accessibility in leverage and shrot selling, derivative (perpetual contract) markets tend to have much better liquidity and higher trading volume than spot markets.

1

0

0