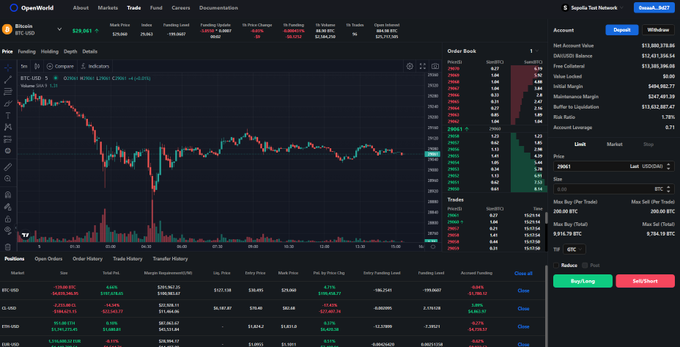

1) Introducing OpenWorld's Core Feature

#2

🚩Order Book Model

OpenWorld implements order book model to assist users in providing and obtaining liquidity, and establishing trading prices. Find out more in the comments below.

Testnet at:

1

0

1

Replies

2) Preview: Compared to AMM or peer-to-pool (oracle-based) model applied by most Defi protocols, order book model offers the best user experience, trading flexibility, price discovery capability, and liquidity providing efficiency.

1

0

0

3) User Friendliness: Order book model has the broadest users’ base around the world. The transition to OpenWorld is made easy for users from traditional finance and crypto centralized exchanges.

1

0

0

4) Flexible Order Types: Under order book model, traders could choose at what specific price to trade by placing limit orders. Orders would be matched by the principle of “Price-Time Priority”. In addition, other order types includes market order and conditional order.

1

0

0

5) Price Discovery: Order book model has strong price discovery capability. Perpetual contract market is still open for trading when its underlying market is closed. The price is discovered purely based on market expectation without any centralized or external intervention.

1

0

0

6) Liquidity Efficiency: In order book model, Market Makers could efficiently provide liquidity by placing buy or sell limit orders around current market price, while control risk to reflect latest market dynamics.

1

0

1