6/◉

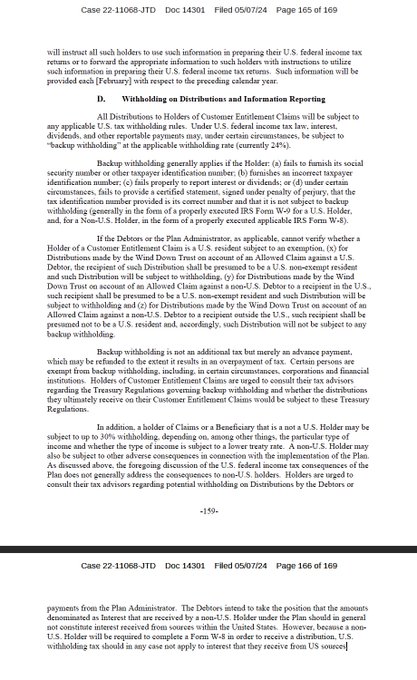

Tax Withholding

No certainty on the tax withholding issue.

Read the final paragraph in whole. It raises more questions than it answers for non-US customers.

3

1

30

Replies

FTX Plan Takeaways

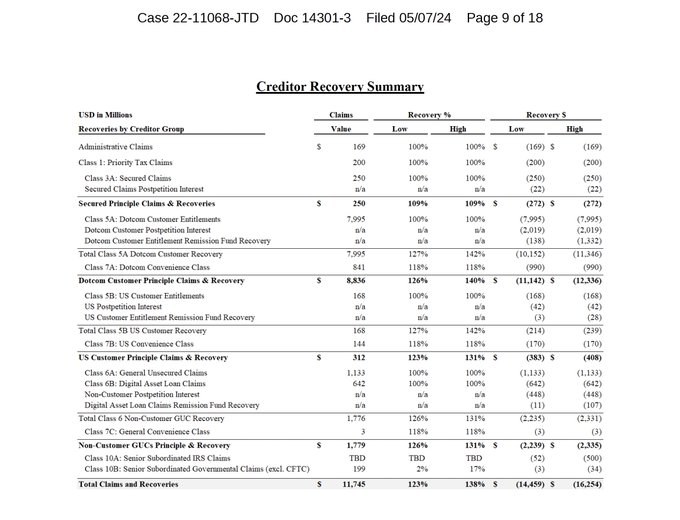

You've likely heard claims below $50k get 118%.

Claims over $50k get 127% to 142% over time.

Now that we have that out of the way, let's talk about the hidden pitfalls in the plan.

Below is what I don't like about the plan.

🧵👇

21

47

203

2/◉

Cash Distributions

I'm fairly disappointed debtors are planning to pay creditors with cash by check or wire.

This is could hurt a lot of creditors living in bad banking countries and/or without dependable mail.

5

2

38

3/◉

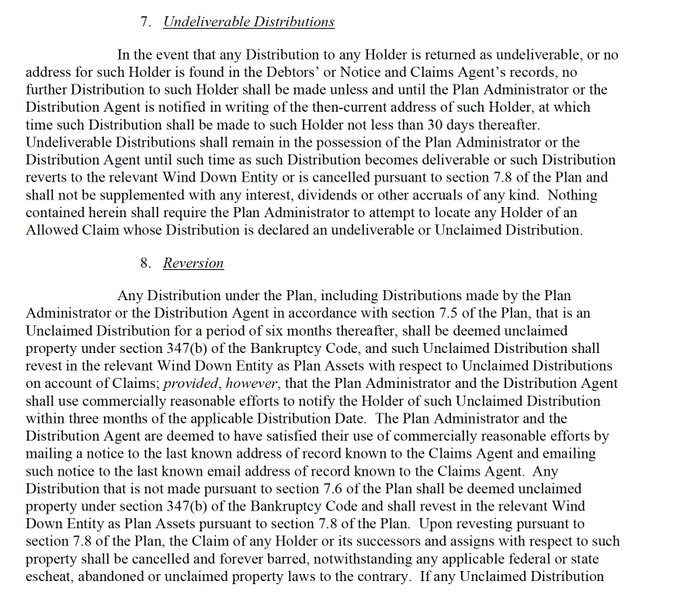

Undeliverable Distributions

You lose your entire FTX claim if you fail to cash your check for 6 months.

Check lost in the mail? Lose your claim.

Accidentally throw away the envelope? Lose your claim.

No address on file and email goes to spam? Lose your claim.

3

1

39

4/◉

Preferences

If you don't vote in favor of the plan, you may be subject to a preference action.

This means if you don't vote at all, you may face a preference action.

Nothing like the threat of litigation to win your vote.

5

1

33

5/◉

KYC Debacle

You have about 90 days to comply with pre-distribution KYC requirements or you forfeit your entire claim.

This means if your KYC issues aren't resolved, you get nothing.

The test for source of income is somewhat subjective, so I expect a lot of litigation…

5

0

23

7/◉

I'll thread more in detail about remaining issues like the trust litigation, likely disclosure statement and plan objections, and how the process likely plays out.

If you have any questions, please list them below. I may or may or not answer them.

5

1

31

@nicholashall

If the claim is done through PwC Bahamas, could there still be a US withholding tax?

1

0

0

@permaoptimist

Don’t know. Not as likely but also not as certain on recovery percentage. Debtors have a settlement agreement in place that requires Bahamas JOL to follow same regulatory adherence including IRS rules but the DS also states the deal may fall apart. In other words, TBD.

1

0

4

@nicholashall

I think the withholding tax is applied on interest only. The principal is untouched. So, it isn't that bad.

1

0

1

@Market0bserver8

Whole point of the disclosure statement is to spell everything out for creditors so that they can make an informed decision when voting on the plan. The fact that withholding isn't plain and clear as applied to claim and/or interest is my point.

0

0

0