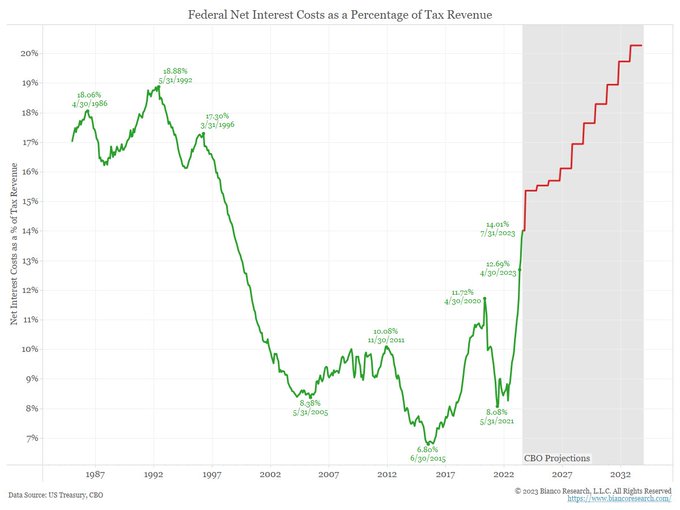

One thing that may come up tomorrow in Powell's speech is the often-heard idea that the Fed has to stop hiking and may even have to cut rates soon because interest expense on the debt outstanding is soaring (see the two charts attached).

The idea that they need to change policy…

194

270

2K

Replies

@biancoresearch

Jim , do you think the election politics is going to play into the speech tomorrow?

2

0

6

@biancoresearch

Exactly. It is estimated that by 2050, half of federal budget will be used to pay interest on the debt. That will be almost 10% of GDP.

This assumes that US doesn't default on its obligation.

2

0

2

@biancoresearch

Yes, but they cannot simply ignore it if it gets to an extreme. Especially, because there isn't any panacea that the congress can use to solve the issue. I guess they can pressure the President to swap the FED head. And I guess that would be a favor to JPowell.

0

0

4

@biancoresearch

Sounds good. In theory ;)

But there is just no way the fed is not influenced by Politicians in one way or the other.

1

0

2

@biancoresearch

Back in the real world, the Fed will do what they are told in the end , the independence they speak of is a facade

0

0

1

@biancoresearch

Jim, I think you’re off on this one. The politics just don’t allow the Fed to contend in the heat of battle that “the Treasury is not our problem.” If they take that position and stick to it, then the politicians will either conspire to end or reform the Fed, or they will print…

8

0

30

@biancoresearch

Agree he'll say this, but he'll be lying: 2008 and Covid showed the Fed will always sacrifice us to bail the feds out.

3

2

36

@biancoresearch

so few understand this. the difference between monetary and fiscal policies. rather everything is “the fed” it’s always just the fed… kneejerk propaganda narrative, albeit with good-ish intentions

3

0

6

@biancoresearch

Jim could this be a feedback loop in that higher yields = higher interest payments = fiscal stimulus (in a sense)? this keeps inflation heavy, rates go up, and until congress limits spending it becomes a self-reinforcing cycle, until something (banks round 2?) breaks?

4

0

22

@biancoresearch

This is the right take. But if rates on the 10-yr break out (for whatever reason), there will be tremendous pressure on Powell to step back in as a buyer to monetize and bring the long end of the curve back down. If he refuses? Katie bar the door.

2

0

1

@biancoresearch

In a vacuum, you are 100% correct, but in the real world of cutthroat politics, the Fed is not immune from Congressional/Presidential pressure.

10

2

142

@biancoresearch

If the treasury market goes haywire at some point due to said debt, then yes, it's the Fed's problem too.

1

0

18