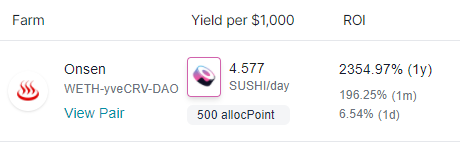

Note: As liquidity builds up in there, I'd expect those numbers to come down to parity with the other Onsen farms.

0

0

27

Replies

In case you are wondering what this is.

1/ If you lock CRV tokens in the Curve DAO, you get back veCRV tokens. The longer you lock, the more veCRV tokens you get. Those veCRV tokens let you claim a portion of the admin fees generated by *all* Curve pools

13

49

222

2/ The yveCRV vault takes your CRV tokens, and essentially locks them forever, but still allows you to claim your share of those fees

1

0

17

3/ The "38% more" above comes from the mutually beneficial relationship between yveCRV and the other CRV auto-farm yearn vaults like y3crv.

The yveCRV locks CRV to boost returns of the auto-farms, and the auto-farms lock some CRV which gives more veCRV to the yveCRV vault

1

2

19

4/ But in the yveCRV vault, your principal is locked up...forever.

That's where the WETH-yveCRV pool comes in. At any point, you can swap your yveCRV for WETH and get your principal back (assuming market price for yveCRV stays near CRV)

1

0

13